WCS Approves Facility Plan For May Ballot

Yesterday evening during Warsaw Community School Corporation’s monthly regular board meeting members of the community and school board met to hear final details on the proposed plan to rebuild Lincoln Elementary and remodel Washington Elementary and Edgewood Middle School.

The meeting began with a short presentation from Dr. David Hoffert, WCS superintendent, who stressed the point that the plan focused only on needs within the district, not wants. According to Hoffert, should the plan be approved, Lincoln Elementary will be rebuilt in a corner of the preexisting property, taking advantage of empty greenway to ensure students are not disturbed during construction. Washington will receive a new wing and Edgewood will have classrooms split up to allow for more space and a better flow of traffic in the building (see WCS Presents Facility Plan: The Bottom Line)

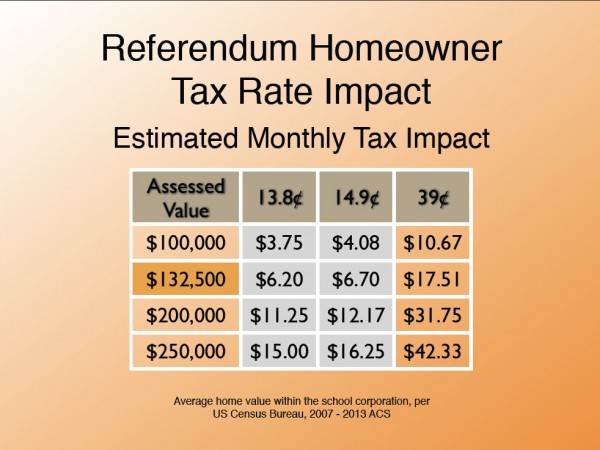

Unlike in the past when school corporations could save money to buy schools, schools must rely on property taxes to make major renovations or build new buildings. Project funding is estimated at $39,900,000 and would increase property tax for the school’s debt service fund no more than 13.8 cents per $100 of assessed valuation over the 20 years of the bond. A presentation was provided by H.J. Umbaugh and Associates that broke down the costs of the project.

According to Curt Fletcher of Umbaugh, the estimated project cost is broken down into “hard construction costs” and “soft construction/financing costs.” The maximum amount projected for hard construction costs is $33,915,000. The maximum for soft construction and financing is set at $5,985,000 and would cover costs such as general conditions, contingencies, furnishings, architectural and construction management fees and other miscellaneous items concerning the project. Fletcher noted that the amount presented is the maximum amount and should the project move forward, costs may be lower but can not cost more than what is proposed.

According to Curt Fletcher of Umbaugh, the estimated project cost is broken down into “hard construction costs” and “soft construction/financing costs.” The maximum amount projected for hard construction costs is $33,915,000. The maximum for soft construction and financing is set at $5,985,000 and would cover costs such as general conditions, contingencies, furnishings, architectural and construction management fees and other miscellaneous items concerning the project. Fletcher noted that the amount presented is the maximum amount and should the project move forward, costs may be lower but can not cost more than what is proposed.

Fletcher noted that should the project be approved by tax payers, repayment will begin in 2016 with a decrease in debt payment occurring in 2024. Fletcher also broke down estimated tax impacts on homes valued at various amounts, noting that the tax is assessed on the net assessed value of a home, which takes into account deductions such as Homestead credits. A home with a market value of $100,000 and a net assessed value of $32,750 would be taxed $3.77 per month. Agriculture would be taxed $3.34 per acre per year and a commercial business with a gross assessed value of $100,000 would see a tax of $11.50 a month or $138 per year.

The community was offered an opportunity to share views on the project after the presentation. Five community members spoke, offering only words of support and excitement for the project.

“I believe that our faculty and our students deserve better,” stated Aaron Hoak, whose children attend Lincoln. “It is time that Lincoln had a facility that matches the quality and caliber of the faculty, and I think you could see even better things from Lincoln Elementary school with a better building. We want to do something for our teachers… we want a building for them.”

School board members also took a moment to discuss views on the project, each assuring all measures possible were taken to cut the cost of the project to keep the tax increase as low as possible. The board then voted unanimously to approve the project to be placed on the May ballot for tax payer’s to decide the fate of the project. The corporation is currently working to procure 125 signatures from registered voters that live in school district and are at least 18 years old.

- Edgewood Middle School proposal.

- Washington Elementary proposal.

- Lincoln Elementary rendering